If expecting handouts and subsidies is too much to ask for, then the very least we expect is for our financial burdens from price inflations on petrol, food, and daily necessities not to be further exacerbated.

Is It True the Government Can’t Do Anything About Rising Fuel Prices?

A key factor in Singapore’s inflation levels spiking to a 10-year high this year has been the spiralling fuel prices in the country.

Due to the ongoing Russo-Ukrainian War and the resulting disruption to global energy markets, crude oil prices are currently hovering around the USD113-114 mark as of May 9, though not as high as the earlier peak of USD126 back in March 2022.

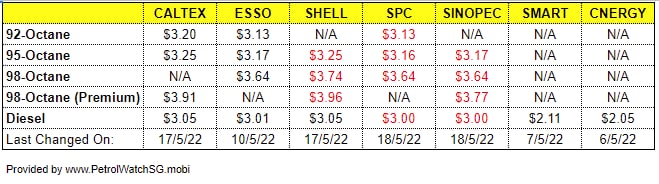

In reflection of high global crude oil prices, Singapore has seen the price of petrol across all grades surge past the $3 mark since March 2022, with the highest prices currently standing at $3.25 for 95-octane petrol (Shell and Caltex) as of 18 May 2022.

Money-printers fuelled by oil

Whilst consumers are suffering from higher fuel prices at the pumps, oil companies are raking in record profits from ongoing crude oil price volatility.

On 5 May 2022, Shell declared record profits of USD9.13 billion for the first quarter of 2022 alone, beating its previous highest quarterly profits back in 2008 even after its decision to write down USD3.9 billion’s worth of its oil and gas portfolio post-tax as a result of its decision to exit operations in Russia. Exxon Mobil (trading under the name Esso in Singapore) also similarly recorded record profits of USD5.48 billion in the same time period.

It is estimated that in the first three months of 2022 alone, the world’s 28 largest oil and gas companies made almost USD100 billion in combined profits from rising crude oil and fuel prices. Most of these profits are being used to pay higher dividends to the shareholders of these companies, or in conducting share buybacks from shareholders to further consolidate ownership and profits in the hands of company owners and managements.

“Tax the rich, subsidise the poor”

Government responses across the world to surging crude oil prices, spiralling petrol pump prices, and the resulting inflation they are fuelling have been mixed. For example, in the UK the main opposition Labour Party called for a vote seeking an amendment to the Queen’s Speech to make references about a proposed one-off “windfall tax” on oil and gas companies. This amendment ultimately failed to pass on 17 May 2022, although there are indications that various current and former ministers supported the idea of such a windfall tax during the parliamentary debate before the vote was conducted.

In other countries such as Ireland, France, Germany and Italy, various measures such as cuts in fuel excise duties, fuel price caps and financial support for certain sectors such as commercial drivers have been implemented.

Many of these countries are facing spiralling fuel costs not just because of volatile energy market prices, but also due to their own actions in boycotting and progressively weaning themselves off Russian oil and gas as part of their geopolitical stand against Russia’s invasion of Ukraine.

Such countries took active and hard choices impacting their oil and gas supplies, and made conscious decisions to fund financial aid and cut taxes to help their societies tide through ongoing fuel price inflations. This is commendable political leadership.

Talk only, no action

Meanwhile, what is the Singapore government doing in response to rising fuel prices?

Back in March 2022 when petrol pump prices first surged past $3, Second Minister of Trade Tan See Leng claimed in a written parliamentary answer that Singapore’s antitrust authorities are “keeping a close watch to ensure petrol companies do not profiteer from the recent surge in crude oil prices”. Minister Tan also claimed that Singapore’s Competition and Consumer Commission of Singapore (CCCS) will take firm enforcement action against coordinated price increases, and that the existence of petrol price trackers online can help better inform local drivers and businesses on comparing different fuel prices from different companies in Singapore.

But apart from such lip service on “keeping a close watch on potential profiteering”, the Singapore government has done nothing to effectively stall and place a price ceiling cap on fuel prices in Singapore in the name of an “open and competitive free market economy”. It is a curious mix of hand-wringing learned helplessness, and slavish subscription to free-market economic dogma that motivates Singapore’s inaction on taking a more active stance in controlling fuel price inflation in the country.

Excuses, excuses…

On one hand, the government tries to justify on the behalf of fuel companies in Singapore that rising fuel prices are but a reflection of rising crude oil prices on the global market due to war-fuelled volatility, something which cannot be helped due to Singapore’s lack of natural resources and resultant heavy reliance on imported energy supplies. On the other hand, government ministers choose to abrogate responsibility for dictating fuel prices to local consumers, saying that petrol-supplying companies will naturally compete using lower pump prices for market share as long as Singaporean society is well-informed by petrol price tracker sites to deter against “unreasonable pricing”.

Both these excuses above do not hold water for several important reasons.

Firstly, many of the European countries which are just as free-market capitalistic as Singapore is have seen it fit to actively intervene in subsidising or capping fuel prices. This goes to show that it is not a matter of adhering to inviolable free-market capitalistic principles but a matter of choice for politicians to show leadership and compassion for the societies they lead during darkening times of economic hardship.

Secondly, many of the countries cutting fuel excise taxes and giving financial aid to subsidise rising fuel prices do not run budget surpluses or have sizeable financial reserves to readily reach for such measures. In contrast, Singapore with its $513 billion in its Official Foreign Reserve and two of the world’s largest sovereign wealth funds not only actively chooses not to subsidise fuel prices in Singapore for local consumers and businesses, but even refuses to set fuel price caps and forego collecting increased tax revenue from existing petrol and diesel tariffs; the higher the pump price the more tax the government collects. Make no mistake, this is an active choice by the government.

If expecting handouts and subsidies is too much to ask for from a government constantly hiding behind narratives of “fiscal prudence”, then the very least Singaporean society should expect is for our financial burdens from price inflations on everything such as petrol, food, and daily necessities not to be further exacerbated and profited on.

Strategic assets placed in foreign ownership: Penny-wise, pound-foolish?

Finally, Singapore could have had a tool in actively managing fuel prices in Singapore. Up till 2009, Singapore actually had a state-owned fuel company in the form of the Singapore Petroleum Company (SPC). SPC ended up being sold off to PetroChina, a PRC state-owned enterprise. Singapore could very well have retained state ownership of SPC much like Petronas is owned by the Malaysian state, and hence had a tool to not only actively participate on the global energy market to secure our national fuel needs at the best prices available without going through foreign energy companies as middlemen, but also provide subsidised fuel prices for Singaporeans (like how Petronas subsidises RON95-grade petrol for Malaysians).

Instead, Singapore is content with being a supplicant price-taker, home to one of the top three global oil trading and refining hubs, with the sixth-largest oil refinery in the world (ExxonMobil Jurong Island), yet having the 8th-highest petrol pricing in the world.

Singapore’s government is not as helpless as it portrays itself to be in the face of rising fuel price inflations. We get the government leadership we voted for as a society, and the political leadership we voted for is comfortable in making easy excuses for inaction in profiteering interventions, motivated by profits at all costs even if it beggars local consumers and businesses.