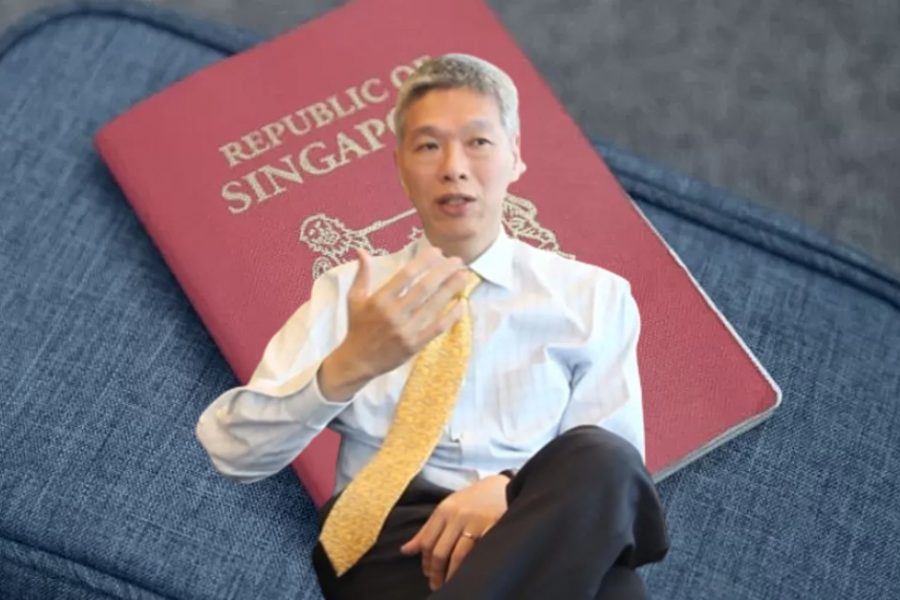

Finance Minister Lawrence Wong said we missed the point about the Budget debate. He explained that as spending increases, we cannot rely on other ways to generate revenue. A GST hike is necessary.

In fact, he said GST hike alone is not enough. It will only account for about $3.5 billion a year when the expected spending in future will increase by $10 billion.

He said he already looked at other alternatives. If they were to put the burden of generating revenue on personal or corporate income tax, it would be “unbearable” for Singaporeans, especially the middle-income group. Similarly, introducing a wealth tax will only make the distribution of burden disproportionate.

Lawrence Wong promised that the GST hike will not hurt the poor as there are GST vouchers to offset the impact. Besides, he said other countries already have high tax rates. It is about time we followed suit.

“So we really should be asking ourselves, why would Singapore be so special? And these [other] countries also have very high income tax rates, easily way above 30 per cent for the middle income. We’re not talking about the top tier.

So why should we somehow think that Singapore would be so different?”

Lawrence Wong at the post-Budget roundtable on 14 Mar 2022

Singapore must be different, unique and better simply because pap ministers know how to pay themselves the world’s highest political salaries by a mile and so, please do not compare yourself with other countries’ ministers for similar policies or performances.

we were always told that g had been saving for the rainy days.

however when those days arrived …

– we were slapped with gst hike

– we were told that it alone is not enough

i guess … something is not right, mr. wrong?

“how much more revenue do we need, mr. wrong?”

i guess he cannot / will not / dares not answer this question.

“The world has enough for everyone’s need, but not enough for everyone’s greed.”

― Mahatma Gandhi