[Contributed by Reesa] Several insurance companies operate in Singapore, but older companies are trusted more by citizens due to their experience and goodwill earned over the years. Nevertheless, we all have long-term plans, and we trust companies like Great Eastern SG to deliver their promises at the end of each investment we go into.

Unfortunately, one netter actually suffered a loss from his endowment plan. In a Facebook post, Lo Chi Meng shared about a shocking e-mail he received from Great Eastern about his plan suffering a loss 3-months before maturity.

GE, is this what you mean by your slogan, “To make life great by providing financial security and promoting good health and meaningful relationships?”

Great Eastern has not been doing well for the last few years and it is hard to say if its projections on GE policies are reliable or not. However, it is clear that they are riding on the perfect excuse of an economic downturn to pay their customers less.

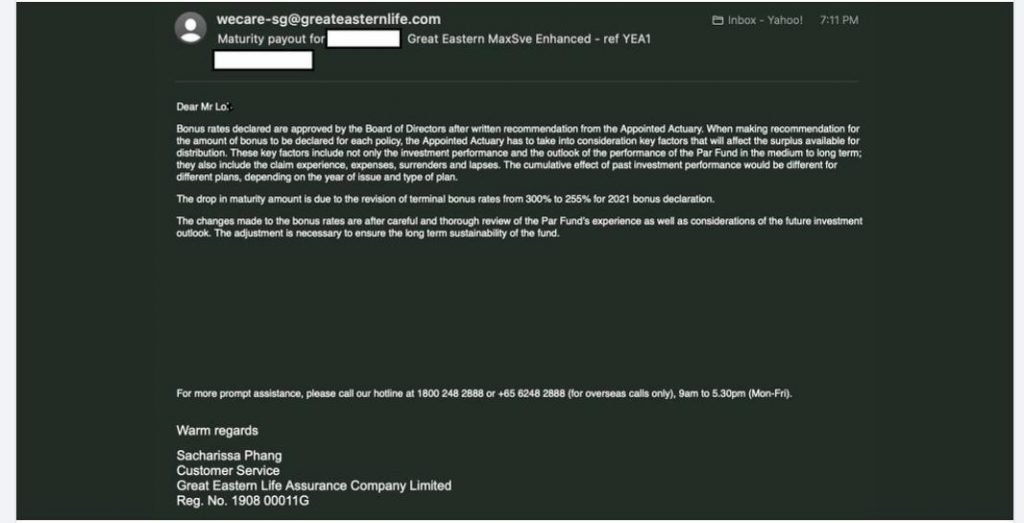

Great Eastern SG declared a drop in maturity amount which affected the terminal bonus rates. This is a loss of hard-earned money of their customers.

In the past few weeks, the customer had contacted GE, but has only received template responses.

This complicated e-mail really doesn’t tell us much about how they calculated their rates.

Nevertheless, no matter what these company promise, maybe its better to trust no one.

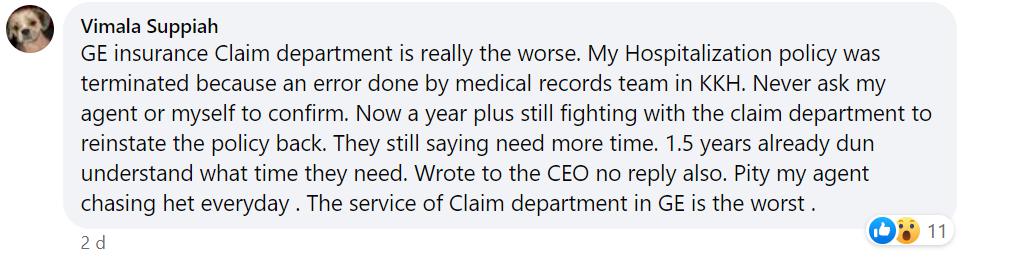

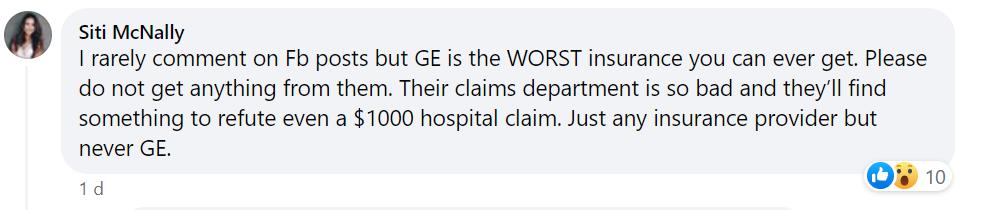

No matter how big the company is, it’s your money. Even a company like Great Eastern has so many complaints.