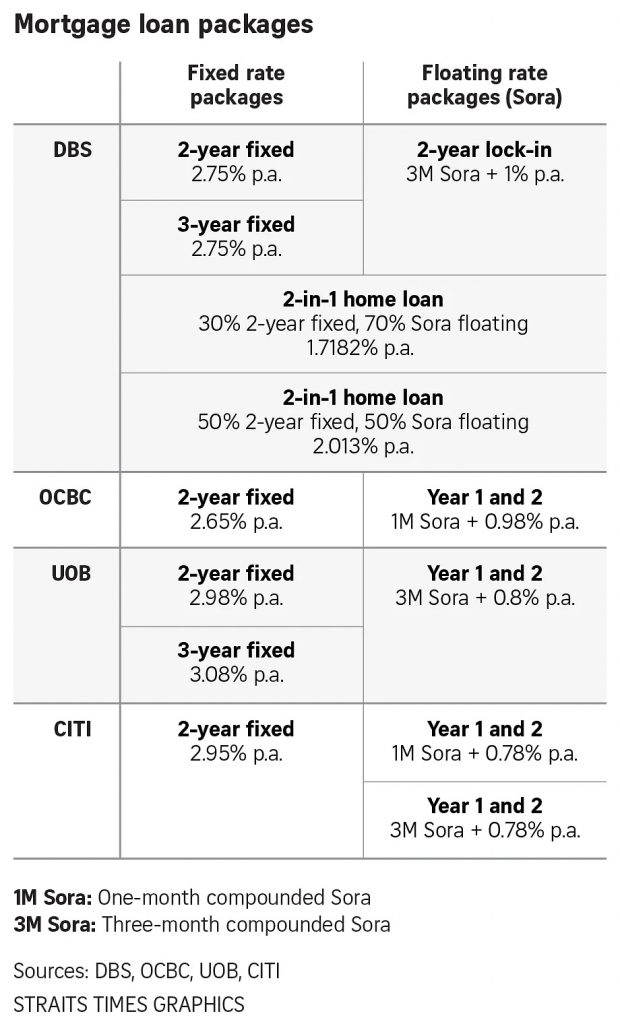

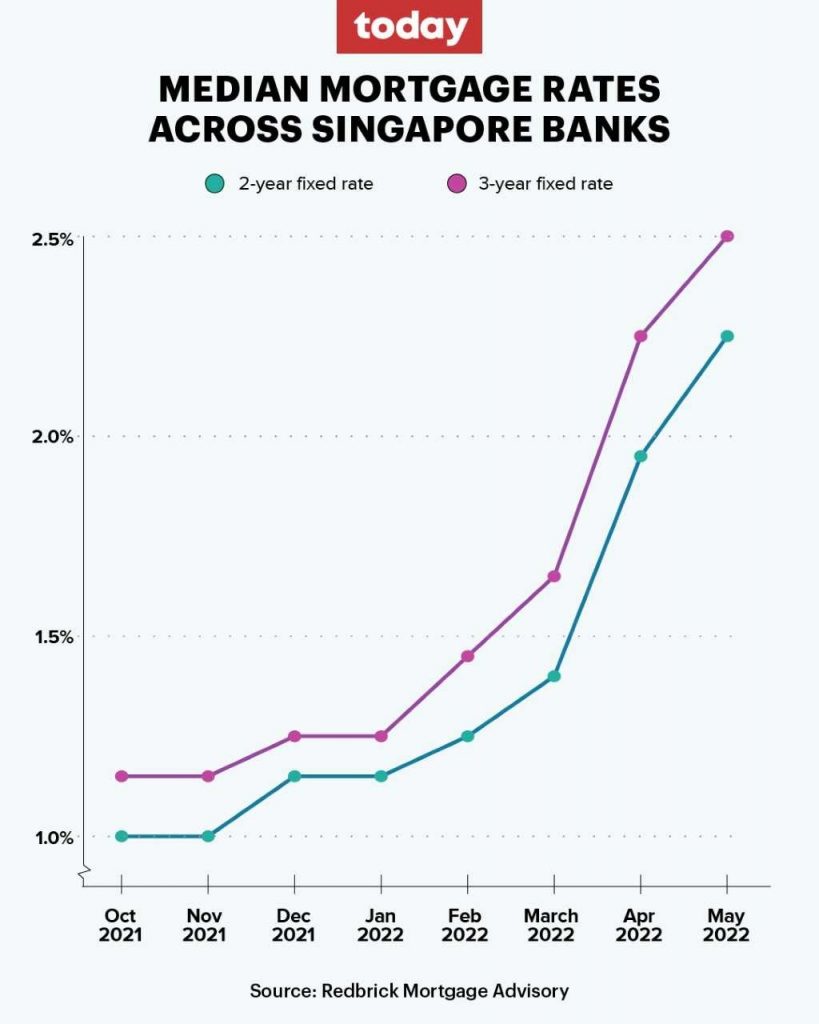

It was just in the news that housing loan rates in Singapore hit a new high, with UOB’s 3-year fixed rate home loan package exceeding 3%. DBS also raised their rates on all home loans to 2.75%.

This is a drastic increase from the end of last year where three-year fixed rates were at 1.15%.

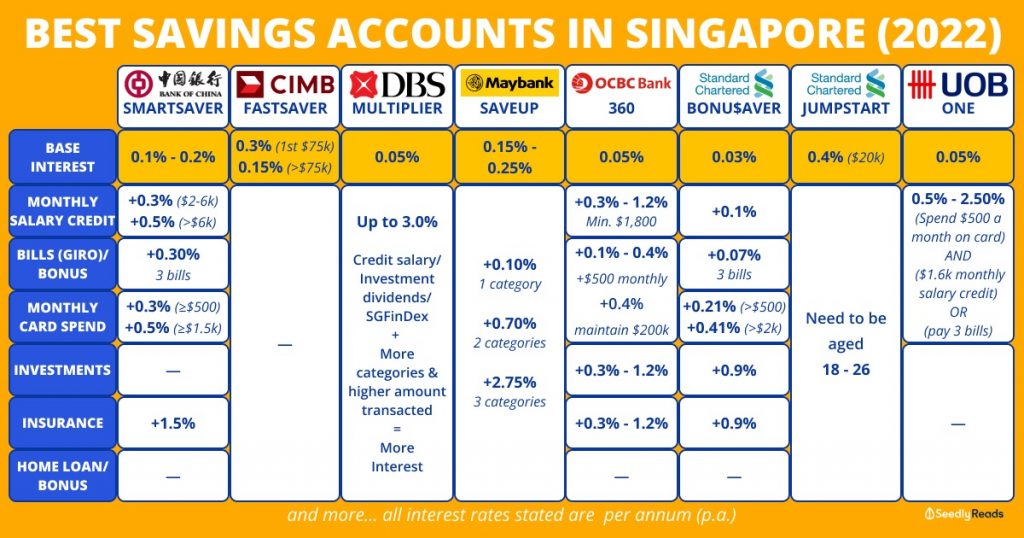

Despite this, the interest rates for fixed deposits are not increasing.

In fact, some are even decreasing. Standard Chartered’s Jumpstart account used to offer a 2% interest rate for the first $20,000. It then decreased to 1% in July 2020, and then 0.4% in January 2021.

Basically, it now costs more to borrow money from banks. The biggest impact would be on lower income Singaporeans who are trying to pay for their flats. Now they have to pay more for their housing, this is on top of the already increasing cost of living. Some may no longer be able to afford their mortgage.

Additionally, they will be getting less money from saving in a bank.

Singaporeans cannot do anything about it.

We now have to fight rising interest rates and foreigners who are able to easily afford multiple condominiums in Singapore. We are definitely on the losing end.

Comments are closed.